https://turbotax.intuit.com There are several factors affecting when you might receive your tax refund. Learn more with this helpful TurboTax video guide.

TurboTax Home: https://turbotax.intuit.com

TurboTax Support: https://ttlc.intuit.com/

TurboTax Blog: https://blog.turbotax.intuit.com

TurboTax Twitter: https://twitter.com/turbotax

TurboTax Facebook: https://www.facebook.com/TurboTax

TurboTax Instagram: https://www.instagram.com/turbotax/

TurboTax Pinterest: https://www.pinterest.com/turbotax/

TurboTax Tumblr: http://turbotax.tumblr.com/

~~~

Video Transcript ~ “When will I get my refund?”:

Once you file your taxes, you might wonder when you’ll get your refund.

Sign in to turbotax.com one to two days after you e-file to see your e-file status.

Once your return shows as accepted, you can start tracking your refund.

To track your federal refund, visit irs.gov/refunds and follow the steps on the website.

Nine out of ten people who e-file get their federal refund within three weeks.

If you send your taxes in the mail, the IRS asks that you wait four weeks before looking up your refund status.

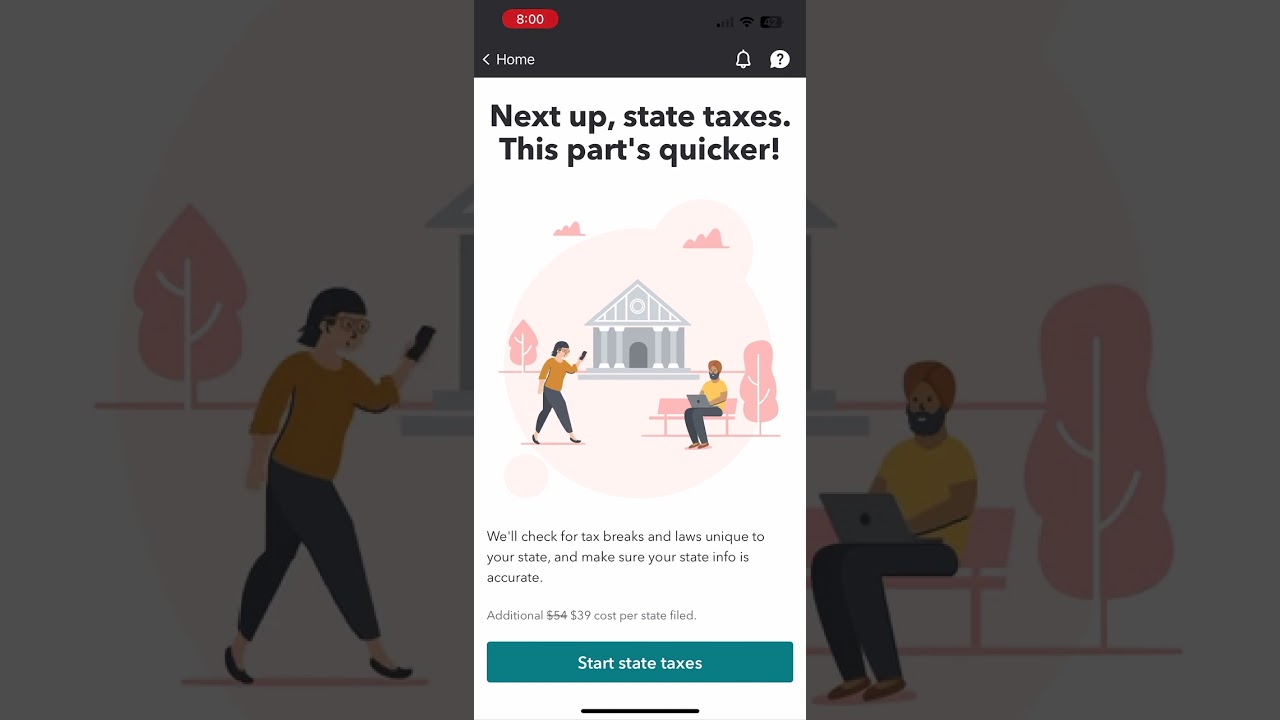

The best way to track your state refund is by going to the state’s tax website.

Sign in to TurboTax and search for state refund.

Select How do I track my state refund? and choose your state.

It can take a couple of days for the IRS and states to update your refund status on their website.

Don’t worry if your refund status doesn’t show up right away.

Just try again in a day or two.

Tracking your refund is easy with the help of TurboTax.

For more answers to your questions, visit TurboTax.com/support

~~~

source