https://turbotax.intuit.com Self-employment has different tax concerns from working as an employee on a payroll. Here’s a guide to what that might mean for you and how TurboTax can help you to stay on track.

TurboTax Home: https://turbotax.intuit.com

TurboTax Support: https://ttlc.intuit.com/

TurboTax Blog: https://blog.turbotax.intuit.com

TurboTax Twitter: https://twitter.com/turbotax

TurboTax Facebook: https://www.facebook.com/TurboTax

TurboTax Instagram: https://www.instagram.com/turbotax/

TurboTax Pinterest: https://www.pinterest.com/turbotax/

TurboTax Tumblr: http://turbotax.tumblr.com/

~~~

Video Transcript ~ “What are Self-Employment taxes? – TurboTax Support Video”:

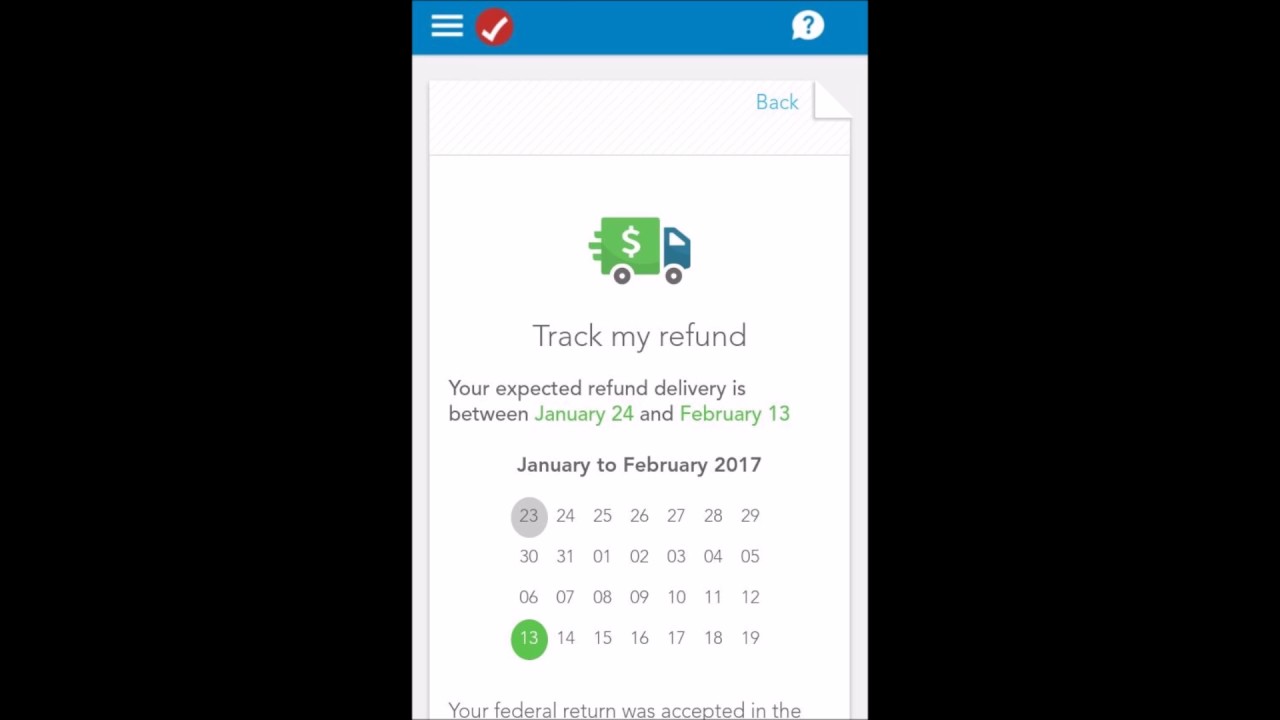

If you’re self-employed, taxes are not deducted from your paycheck. Instead, you make estimated payments during the year for your income taxes and self-employment taxes.

If you didn’t make estimated tax payments, you’ll pay these taxes when you file your return. TurboTax will walk you through the process.

Even though they’re both reported on the same return, income tax and self-employment tax are two separate taxes. Self-employment tax is the Social Security and Medicare tax you pay as a self-employed person. If you have at least $400 in net income after you enter all of your expenses, TurboTax will create a Schedule SE to calculate your self-employment tax. Which will equal 15.3% of your self-employed income—that’s 12.4% for Social Security, and 2.9% for Medicare.

These amounts include both the employer and employee portions because you’re working for yourself. Luckily, you can claim a federal deduction for half the self-employment tax you pay, which can help lower your taxes. We’ll automatically calculate this for you as you complete your return.

For more answers to your questions, visit TurboTax.com/support

~~~

source