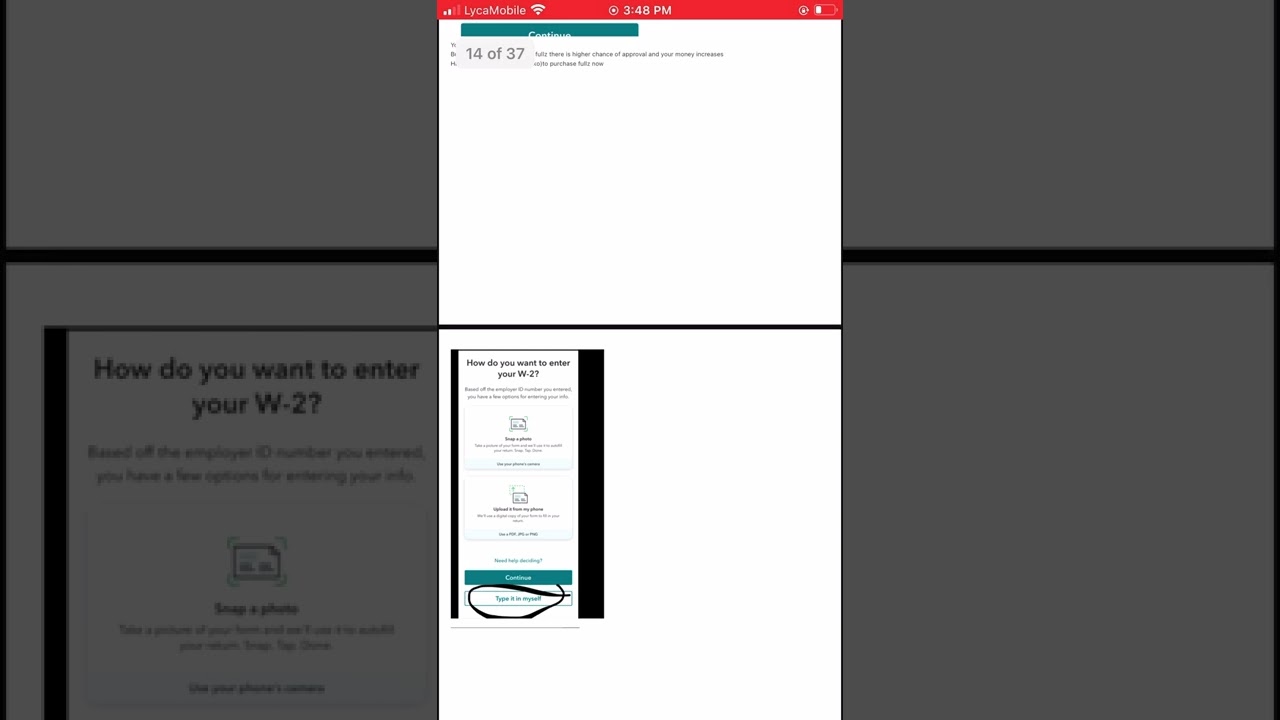

https://turbotax.intuit.com Everyone wants to reduce as much of their tax liability as possible. CPA and TurboTax tax expert Lisa Greene-Lewis details some of the most commonly overlooked deductions you might be missing.

TurboTax Home: https://turbotax.intuit.com

TurboTax Support: https://ttlc.intuit.com/

TurboTax Blog: https://blog.turbotax.intuit.com

TurboTax Twitter: https://twitter.com/turbotax

TurboTax Facebook: https://www.facebook.com/TurboTax

TurboTax Instagram: https://www.instagram.com/turbotax/

TurboTax Pinterest: https://www.pinterest.com/turbotax/

TurboTax Tumblr: http://turbotax.tumblr.com/

~~~

Video Transcript ~ Title: The 5 Most Overlooked Tax Deductions – Presented By TheStreet + TurboTax

– [Lisa] TurboTax helps you navigate the 2020 tax season.

– Lisa Greene-Lewis, CPA and tax expert at TurboTax, is here to tell us about the most overlooked tax deductions.

– There’s actually deductions and credits that are overlooked, so the Earned Income Tax Credit, that’s a credit for low to moderate-income workers. The IRS reports that one in five taxpayers miss that tax credit, and it could be because maybe their income levels change and they don’t realize that they’re eligible. There’s another one that’s about the same ratio, one in five people miss it, it’s the Saver’s Credit, and it’s a credit that you get just for investing in your retirement, so your IRA or your 401 , and it can be up to $1,000 if you’re single and $2,000 married filing jointly. Don’t forget, if you paid student loans, I know student loan debt is huge, so you’re able to deduct your student loan interest up to $2,500, and also another one that people don’t realize, so if you took even one college course to improve your skills or get that promotion, you may be eligible for the Lifetime Learning Credit, up to $2,000. Charitable contributions, people clean out their closets throughout the year, but they lose their receipts, so a lot of people forget about those and miss out on those, or they don’t even realize driving to volunteer, their mileage can be deductible.

– And if you miss a tax deduction, can you get it later or is it just gone forever?

– Yes, so if you missed a deduction, you can go three years back and claim that deduction or credit, so right now coming up on April 15th, if you didn’t file your 2016 tax return or you missed a deduction or credit, you have until April of this year to file that return.

~~~

source